FCM lauds one-year doubling of gas tax transfers to municipalities

Posted in: News Item

Date Posted: 2021-03-25

Organization Name: Federation of Canadian Municipalities

Public health measures needed to contain COVID-19 have greatly impacted municipalities’ revenues and their ability to fund their operations.

On March 25, the federal government proposed a one-time investment of $2.2 billion that would help address infrastructure priorities in municipalities and First Nations communities. The funds would flow through the federal Gas Tax Fund, a long-term, indexed source of funding for over 3,600 communities across the country. In recent years, it has supported thousands of infrastructure projects annually.

This would double the federal government’s regular funding for municipalities in 2020-21 and it would provide much needed funding for communities of all sizes to help reduce the risk of infrastructure projects being delayed or cancelled.

Following the announcement, officials with the Federation of Canadian Municipalities (FCM) lauded the increase in the Gas Tax Fund.

“The Gas Tax Fund directly empowers communities of all sizes to create jobs by meeting real local infrastructure needs,” said FCM President Garth Frizzell. “Whether that’s fixing a bridge, energy-retrofitting a local arena, revitalizing main street, or expanding a community centre for vulnerable residents. Doubling next year’s allocation means more jobs and better lives for Canadians—with the pace that’s needed to kickstart Canada’s recovery. FCM members welcome this step, and they’re ready to turn this investment into results for Canadians.”

By using the federal Gas Tax Fund to provide the $2.2 billion one-time investment, communities will quickly be able to access the funding for priority infrastructure projects.

The government also proposed to rename the federal Gas Tax Fund as the Canada Community Building Fund to better reflect the program’s evolution over time to a flexible and permanent source of federal infrastructure funding to support community infrastructure projects. The current name is also outdated, as there is no longer any direct link between the federal Gas Tax Fund and the gasoline excise tax.

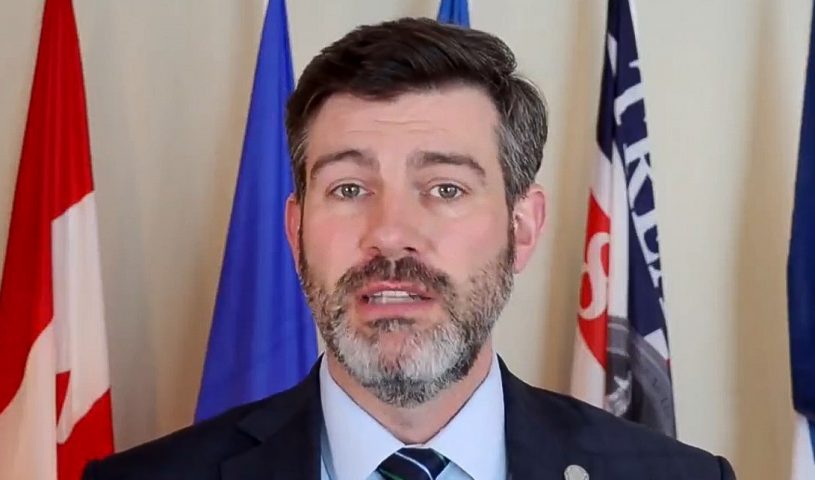

“Doubling the Gas Tax Fund signals that the federal government means business on recovery. GTF funding flows directly to our cities, and we turn that very quickly into better lives for residents,” said Edmonton Mayor Don Iveson, chair of FCM’s Big City Mayors’ Caucus. “That means everything from better transit for lower emissions to better recreation facilities that promote health and social inclusion. Doubling down on this progress now means more jobs and growth for Canadians at an absolutely critical moment

The federal Gas Tax Fund includes 18 different project categories, including transit, water and wastewater, sport infrastructure, and roads. Communities can use the funds immediately for priority projects, bank them for later use, pool the dollars with other communities for shared infrastructure projects, or use them to finance major infrastructure expenditures.

“Rural communities drive a third of Canada’s economy. That makes us key to Canada’s post-COVID recovery, and growing the Gas Tax Fund helps us meet that challenge,” said Rural Municipality of Cupar Reeve Ray Orb, chair of FCM’s Rural Forum. “This tool puts rural communities in the drivers’ seat, and we use it to move local projects forward quickly. Doubling next year’s transfer will deliver everything from better rural roads and bridges and recreation facilities to upgraded water and wastewater systems that protect the local environment. And that means more of the jobs our communities need right now.”

For more information on how the allocations are broken down by province and territory, please visit the Federal Gas Tax Fund Allocation Table.